Since the issuance of the Independent Review Committee on Standard Setting in Canada (IRCSS) Final Report in March 2023, Canada’s oversight councils, along with standard setting’s funder, CPA Canada, have been working to assess the IRCSS’ recommendations for implementation.

Read these top five (5) frequently asked questions (FAQs) as both a reminder and update in advance of decisions anticipated in Fall 2023 – decisions that will pave the way forward for standard setting in Canada for years to come.

Please note that these FAQs were prepared by the staff supporting the assessment of the IRCSS’ recommendations.

Have more questions? Contact us.

1. Why establish Standardsco?

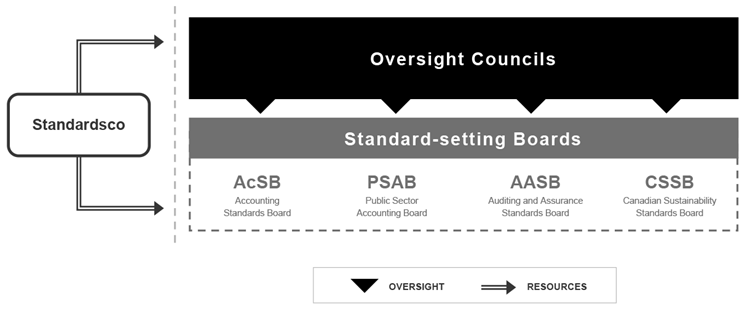

A separate legal entity, referred to with the placeholder name Standardsco in the Final Report, is recommended by the IRCSS to support and enable the overall activities of the Canadian standard-setting model.

Proposed new Canadian standard-setting model

But why?

The phrase “fit for the future” best captures the rationale for establishing Standardsco.

A focus of this recommendation is to ensure there is an entity set up to facilitate the overall management of the IRCSS’ proposed new funding model for standard setting – with diversification of funding a key tenet. This means that, while CPA Canada is currently the sole funder of standard setting in Canada, the IRCSS recommends a new a funding model be put in place with diversified sources of funding – in addition to CPA Canada. It’s important to note that CPA Canada’s funding support of standard setting is expected to stay consistent with current levels. Funding from other sources is expected to support the costs of emerging areas and needs – most notably, sustainability standards.

Establishing a separate legal entity is a critical part in facilitating this new funding model, as well as further fostering independence of standard setting from the CPA profession. On top of this, establishing Standardsco will also enable increased flexibility to respond to current and emerging standard-setting needs – ensuring long-term financial sustainability for current and future activities.

For more information, see IRCSS recommendations 1-3 and 19.

2. Does Standardsco change the relationship between standard setters and CPA Canada should these recommendations be approved and implemented?

It’s important to note that the establishment of Standardsco does not eliminate CPA Canada’s role in standard setting. In fact, the IRCSS Final Report highlights the need to ensure that the benefits of the existing framework are preserved while also achieving a higher level of independence.

More specifically, should Standardsco be approved and established, an agreement for secure and long-term funding for standard-setting activities would be established between Standardsco and CPA Canada.

Standardsco would also require many support services – services currently provided to standard setters by CPA Canada. This includes information technology, finance, translation, and human resources. It is expected that these services will continue to be provided by CPA Canada via shared-services agreements with Standardsco. The IRCSS also recommends that CPA Canada staff who support standard-setting activities be contracted to Standardsco – a further step to preserve standard setting’s independence.

Standards as a public good

The concept of standards as a public good is highlighted by the IRCSS in their Final Report.

To support this, the IRCSS recommends that CPA Canada continue to hold stewardship responsibilities and own intellectual property relating to standards and control their distribution, with CPA Canada continuing to publish the CPA Canada Handbook.

A related recommendation is to provide access to final standards – a public good – free of charge. The IRCSS acknowledges that this has funding repercussions for CPA Canada, which will be a consideration in any implementation or change.

It is important to note that the IRCSS recommended that final standards be provided free of charge, but noted that access to other materials in the CPA Canada Handbook such as non-authoritative guidance (e.g., illustrative examples, bases for conclusions) would continue to be restricted to CPA Canada members and other paying subscribers – an approach similar to that of the IFRS Foundation’s provision of unaccompanied standards.

For more information, see IRCSS recommendations 4-8.

3. What’s going on with the Canadian Sustainability Standards Board?

Investors and many others around the world are demanding higher-quality information and insights. They want to know about an organization’s performance, risks, opportunities, and long-term prospects, and are looking beyond what is available in conventional financial statements. This includes information about climate and other environmental, social and governance matters.

With the establishment of the International Sustainability Standards Board in November 2021, the IRCSS was quick to issue an early recommendation to also establish the Canadian Sustainability Standards Board (CSSB) – approved in June 2022.

At the time of this FAQ posting, the CSSB is now operational and is in its early days of establishing its multi-year strategy.

Assurance

In considering the need for a CSSB, the IRCSS also addressed the demand for assurance of sustainability information in their Final Report.

There is general agreement that existing assurance standards will need to be enhanced to support sustainability reporting engagements. The IRCSS recommends the Canadian Auditing and Assurance Standards Board (AASB) assume responsibility for setting sustainability assurance standards for Canada.

The AASB is already working closely with the International Auditing and Assurance Standards Board, which issued its Exposure Draft, International Standard on Sustainability Assurance (ISSA) 5000, General Requirements for Sustainability Assurance Engagements in July 2023. It will be important to monitor developments in sustainability reporting and assurance in both Canada and internationally.

For more information, see IRCSS recommendations 10 and 15-16.

4. How will oversight work with the new CSSB and Standardsco?

A joint effectiveness review of the current oversight processes was recommended to be undertaken by the IRCSS in its Final Report – with this review already well underway at the time of this FAQ posting.

Oversight is currently being conducted by the Accounting Standards Oversight Council (AcSOC), the Auditing and Assurance Standards Oversight Council (AASOC), and, on an interim basis, the CSSB Implementation Committee. However, the IRCSS believes that such a review has the potential to result in all oversight activities being consolidated into a single oversight council. This would allow for a single body to facilitate connectivity amongst the standard-setting boards, ensuring effective and holistic oversight. The oversight councils will make a final decision on this recommendation when the joint effectiveness review is complete – anticipated in Fall 2023.

For more information, see FAQ 5 below and IRCSS recommendation 11.

5. What happens next?

The IRCSS Final Report is addressed to the three bodies who initiated the Committee’s review: Canada’s two oversight councils, AcSOC and AASOC, and CPA Canada.

AcSOC and AASOC formed two joint committees to address the various recommendations:

- The Effectiveness Review Joint Taskforce: This Taskforce, with the assistance of an independent third-party governance expert, is reviewing the oversight councils’ existing processes, considering information from international comparators, and assessing what structure and processes would be optimal for the future. As noted in FAQ 4 above, the councils are expected to jointly discuss this Taskforce’s work and make decisions on the future structure of oversight in Fall 2023.

- The IRCSS Review Working Group: A joint working group consisting of AcSOC and AASOC, along with CPA Canada, is considering the IRCSS recommendations overall – and analyzing them in the context of whether and how they might be implemented. The councils will meet with CPA Canada to determine the path forward on each recommendation in Fall 2023.